Medicare tax is collected from people working in the United States. According to the Federal Insurance Contributions Act, taxes for Medicare and Social Security are deducted from the paychecks of both workers and employers (FICA).

Understanding Medicare Wages

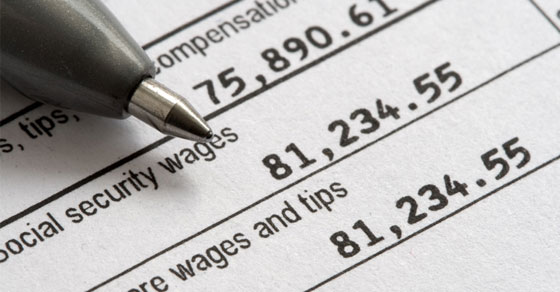

There is no upper limit on salaries that qualify for Medicare. The amount of the employee's contribution to Medicare tax deducted from their paycheck is expressed as a percentage. The individual tax rate for Medicare will be 1.45 percent of taxable salaries beginning in the years 2020 and 2021. In addition, employers contribute 1.45 percent. For salaries over $200,000, there is an Additional Medicare Tax of 0.9 percent, which is paid by the employee only if they file their taxes as an individual.

Those whose salaries exceed $250,000 are subject to the extra tax if they submit a joint return, and those whose wages exceed $125,000 are subject to the additional tax if they file a separate return as a married couple. The Social Security tax rate will remain the same in 2021 at 12.4 percent, with employees paying 6.2 percent and employers also contributing 6.2 percent, making the overall rate the same as in 2020. The tax is levied on the taxpayer's income, beginning at $142,800 in 2021 and continuing to $147,000 in 2022.

Medicare Tax for the Self-Employed

The Self-Employed Contributions Act (SECA) mandates that self-employed people pay taxes to Social Security and Medicare in addition to their contributions. The Medicare tax rate for a self-employed person is 2.9 percent on their income in 2021 and 2022, while the Social Security tax rate is 12.4 percent for those same years.

Self-employed people are responsible for paying twice as much in Medicare and Social Security taxes than regular workers, given that employers normally cover half of these taxes. However, they are permitted to deduct fifty percent of the taxes that they pay toward Medicare and Social Security from the taxes that they pay on their income.

The CARES Act of 2020

The CARES (Coronavirus Aid, Relief, and Economic Security) Act was passed into law on March 27, 2020, after it was signed into effect by former President Trump. This act was a $2 trillion emergency stimulus program for the coronavirus. It broadens Medicare's capacity to pay for treatment and services for those afflicted with COVID-19. In addition, the CARES Act:

- Expands Medicare's ability to fund telehealth services while maintaining its current level of flexibility.

- Medicare payments for COVID-19-related hospital stays and durable medical equipment are increased due to this bill.

The CARES Act clarifies Medicaid, stating that non-expansion states are permitted to utilize the Medicaid program to fund COVID-19-related treatments for uninsured people who, had the state decided to expand Medicaid, would have been eligible for Medicaid under the expanded program. Under this state option, coverage is available to more groups with just a limited amount of Medicaid coverage. It is anticipated that the modifications to Medicare brought forth by the CARES Act will remain in effect until the epidemic is over.

Special Considerations

An employee should think about the many choices available for saving for retirement in addition to keeping track of the specific amounts deducted from each paycheck for Medicare and Social Security. You have the option, in many situations, of having a part of this purposeful deduction taken out of your paycheck. The length of time an employee has been with an organization (often referred to as vesting) and the kind of organization both have a role in determining the retirement plan options that are made available by many companies (company, nonprofit, or a government agency).

For instance, a 401(k) plan is provided by a lot of employers. Contributions to a 401(k), which is a qualified employer-sponsored retirement plan, may be made via salary deferral by workers who are eligible for the plan. A 401(k) account allows for the accumulation of earnings on a tax-deferred basis. A 403(b) retirement plan is analogous to a 401(k) plan, except it is intended only for workers of public schools, tax-exempt organizations, and some pastors. These groups are excluded from participation in 401(k) plans. State and local government workers are eligible to participate in a retirement program known as a 457 plan.

Mutual funds are the most frequent investment option provided by 401(k) plans. Employees are given the option to invest their money in a tax-deferred annuity plan or a Roth account if the plan is a 403(b). If your employer does not provide a retirement plan, another option for you to save for retirement is to open an individual retirement account (IRA). Alternatively, you can use an IRA to save more money for retirement than the money saved in an employer-sponsored plan.